Fish is one of the world’s most traded food, with demand expected to increase another 15% in the next decade. The most traded animal protein, seafood has a trade value of 3.6 times the size of beef, five times that of pork, and eight times the size of the global poultry trade. In 2021, the value of the global seafood trade grew by USD 13 billion, reaching a new peak of more than USD 164 billion.

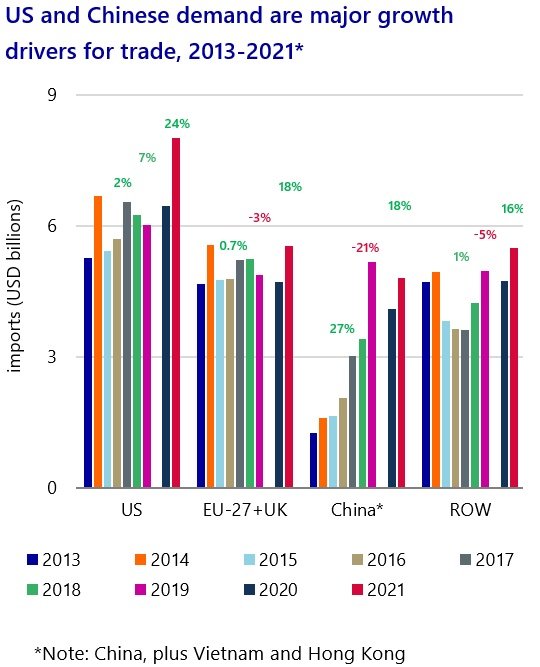

The US and China are driving demand

The US is the fastest-growing market for seafood imports and it recovered more than expected in 2021. The demand is driven by health- and sustainability-conscious consumers, particularly among millennials and baby boomers. Due to a combination of continued at-home consumption and strong food service recovery, imports of high-value species increased and it is expected that the long-term seafood demand will continue rising in the US.

On the other side, Chinese imports took a hit during the pandemic and have not fully recovered to 2019 levels. China is one of the most important seafood markets, with a growing middle class interested in high-value products. Since domestic production does not satisfy local demand, China is increasingly dependent on imports, especially for shrimp, crab, and salmon. As a result, the country is planning to expand aquaculture production to meet local demand.

“In the short term, we do not expect a significant increase in volumes, and therefore we anticipate the limited impact on trade flows,” said Sharma. “For now, COVID-19 restrictions will continue to impact the market. However, we expect these measures to be temporary, and imports should return to normal levels in the long term,” said Novel Sharma, analyst – seafood at Rabobank.

Salmon and shrimp continue their ascent

Farmed salmon was one of the winning products of the decade, especially in Europe and the US. Trade value dropped in 2020 but has rebounded since consumers continued to cook more fish at home.

“Post-pandemic, the salmon trade’s value has been fueled by high prices due to increasing demand and restricted supply growth. Expansion of volumes will be essential for continued growth,” said Sharma.

Shrimp, the most traded seafood, is at an inflection point. Following record demand and supply in 2021, prices have been dropping since the second quarter of this year. Their short production cycle allows exporters to respond quickly to demand changes, however shrimp demand and prices have come down while feed, freight, and energy costs are still high, impacting farmer profitability.

“This falling demand is likely to cause a short-term trade decline,” said Sharma. “Still, we do believe in shrimp industry growth. The industry is supported by strong, long-term demand, given shrimp’s position as a healthy and convenient seafood product with universal appeal.”