According to a new Rabobank report, the global salmon industry will continue to be the most profitable aquaculture sector. The shrimp industry is struggling to stabilize amid oversupply, low prices, and weak Chinese import demand. Global fishmeal supply is expected to improve, given weakening El Niño conditions, and prices should normalize.

In 2023, the shrimp farming industry faced one of the most challenging years for more than a decade. Weak shrimp demand in the West, combined with persistently strong supply from Ecuador, created price levels even lower than the lowest point in the pandemic (2H 2020), while costs remained elevated due to high feed prices.

According to Gorjan Nikolik, senior global seafood specialist at Rabobank, “normalizing salmon supply and likely better fishmeal and fish oil production will soften prices in 2024, but only marginally, establishing a new higher price normal. For shrimp, the current low prices may also become the new normal.”

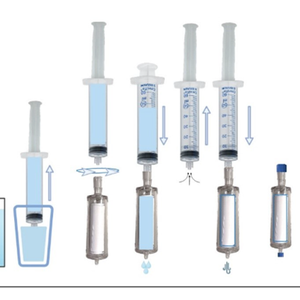

Fishmeal is expected to see much better supply, as the effects of El Niño in Peru are receding, although risks remain. Fishmeal demand remains good, but it is likely to be influenced by the lower prices of vegetable alternatives.

Positive, but low supply growth for salmon

The salmon industry will again be the most profitable sector in the first half of 2024, with high prices and marginally lower feed and biological costs supporting strong farmer profitability. However, biological challenges remain the main risk factor.

“Relative to the first half of 2023, supply will be boosted by likely better biological conditions in Norway, Canada, the UK, Faroe and Iceland,” said Nikolik. “Chile, however, is a risk factor. Part of the lower supply expectation is due to legislation at the company level. We could see further biological challenges induced by El Niño.”

Low shrimp prices, the “new normal”

The shrimp industry, on the other hand, is facing uncertainty, with low prices and weak demand making it hard to predict when the market will stabilize. “Without a supply reduction, prices will remain at low levels. A key concern is the weakness in Chinese import demand. While Chinese demand may still be positive, high inventory levels and a slightly lower renminbi will dampen a shrimp price recovery,” explained Nikolik.

Fishmeal supply and prices to normalize

Fishmeal supply is expected to improve as El Niño conditions weaken, enabling a normalization of prices. “With El Niño conditions expected to weaken throughout the first half of the year, we can expect fishing in Peru to improve,” said Nikolik. “Consequently, better fishmeal supply should enable normalization of the price as terrestrial commodity alternatives, such as soybean meal, have been easing in price throughout 2023, with further mild softness expected for the first half of 2024.”